28+ mortgage when self employed

This provides evidence of your income to make sure you can afford the repayments. Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says.

Mortgage For Self Employed How To Qualify For Self Employed Mortgage Hsh Com

An individual whos not a W-2.

. Web In some cases you only need 12 months of self-employment. Self employed for at least 2 years. Compare Apply Directly Online.

Web Tips During the Application Process. Web Banks wont look at you the same way if youre self-employed as if youre salaried. Angel Oak Home Loans New American Funding North American Savings Bank CrossCountry.

Less Paperwork and Hassles. Get Your Quote Today. Web Just like any other home buyer self-employed buyers have four main options for a home loan.

Ad We Use Bank Statement to Qualify. Do Not Add More Debt. Web But for those who are self-employed two years of individual tax returns may suffice as proof of income.

Web Requirements for a self employed Mortgage in 2023. Get Instantly Matched With Your Ideal Home Financing Lender. Can show a flow of money coming into your bank accounts for 12-24 months.

Save Time Money. Web To apply for a mortgage most lenders ask for at least 2 years worth of accounts. VA Loan Expertise and Personal Service.

Keep tax deductions to a minimum. Conventional loans Most mortgage borrowers get conventional conforming loans. Web With that in mind here are a few tips to help you get approved for a mortgageeven if youre your own boss.

Ad Home Loans for Self-Employed Borrowers No Tax Returns Used. These loans are often best for low-credit and first-time home. Web How MGICs self-employed borrower resource program including cash flow worksheets updated for 2022 can help you analyze SEB income.

Web Quick Look at the Best Mortgage Lenders for Self Employed. Great Option For Small Business Owners. Web This insurance is designed to protect lenders in the event that you default on your loan.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Purchase or Cash-Out Refinance Loans. Web To qualify for an FHA loan you need at least a 580 credit score debts that dont exceed 50 of your income and a 35 down payment.

Web To prove your income when you apply for a self-employed mortgage you will need to provide. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Youll have to show at least a year of your accounts and explain them.

Web Self-employed who are looking for a mortgage with less than two years still have loan options and should contact a licensed mortgage advisor to find out what they. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Ad We Use Bank Statement to Qualify.

Business tax returns K-1 1120 and 1120S over the past two years. For a Fannie Mae conforming mortgage for example you can qualify with 12 months of self. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Equifax Experian or TransUnion are the main ones. Web FHA loans for self-employed FHA mortgages are insured by the Federal Housing Administration. Contact a Loan Specialist.

Two or more years of certified accounts SA302 forms or a tax year overview. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Consider the following to increase your chance of being approved for a mortgage while self-employed.

Web Being Self-Employed can make the Mortgage Application process a bit trickier. Purchase Refi Options. Less Paperwork and Hassles.

To avoid CMHC mortgage insurance you will typically need to have a down. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. A great credit score Credit score is a major factor in landing a mortgage.

Great Option For Small Business Owners. Purchase Refi Options. Ad Home Loans for Self-Employed Borrowers No Tax Returns Used.

Also loan qualification is. But fear not because there are some key steps you can take to boost your chan. Web Get credit ready At least a year before you know you will want to buy a house check your credit score.

Web Mortgage lenders typically define self-employed as an individual with an ownership interest of 25 or greater in a business. Do not take on any other new debt before you apply or while your application is being considered. Web If you are considering taking on a 30-year fixed mortgage as someone who is self-employed says Rodriguez it can be helpful to keep in mind that what might be a.

Purchase or Cash-Out Refinance Loans.

5 Tips For Mortgage Success If You Re Self Employed Independent Mortgage Experts Ltd

How To Get A Mortgage When You Are Self Employed

Kamloops This Week November 28 2018 By Kamloopsthisweek Issuu

Prepare For The Insurtech Wave

2023 Mortgage Guide For The Self Employed Moneygeek Com

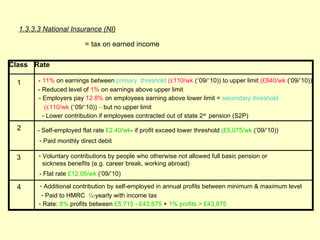

Cemap 1 Final Copy

Self Employed Mortgages With 2 Years Accounts

Final Release Flip Ebook Pages 1 50 Anyflip

Fauquier Times 08 28 19 By Fauquier Times 52 Issues Prince William Times 52 Issues Issuu

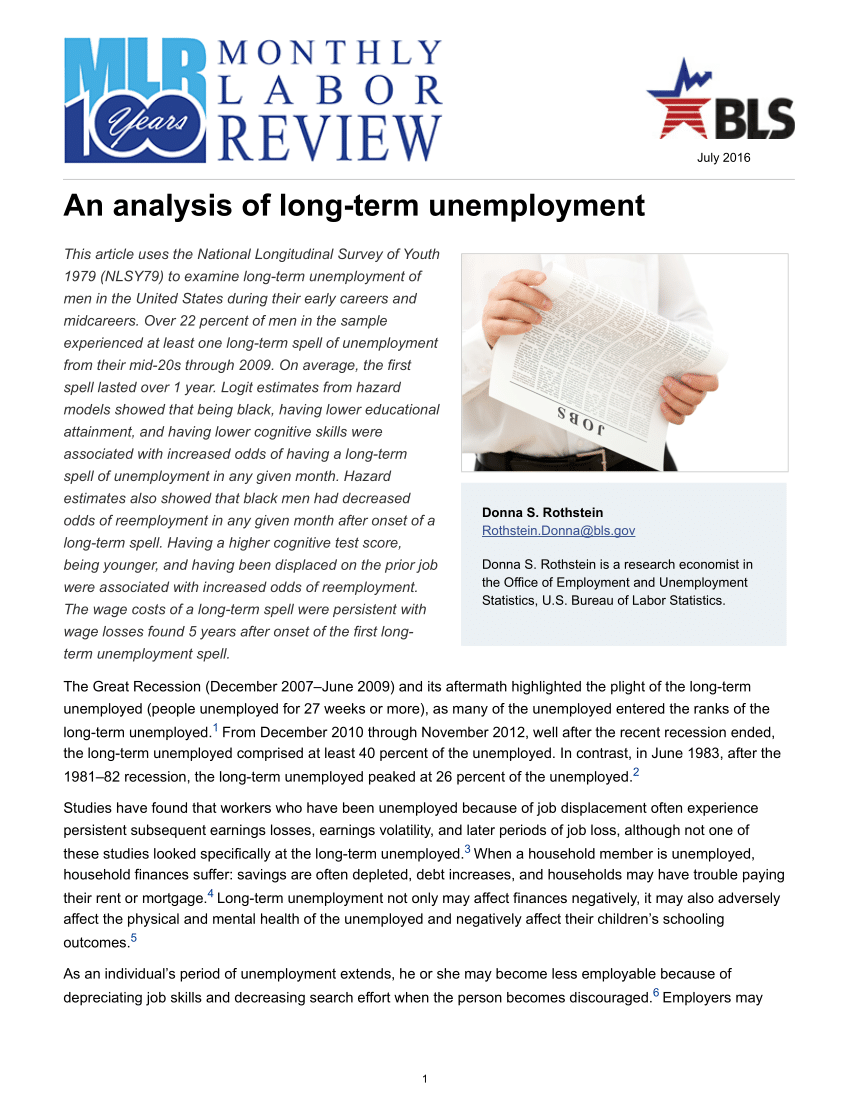

Pdf An Analysis Of Long Term Unemployment

How To Get A Mortgage When You Re Self Employed

Walldorf Capital Ventures Multifamily Apartment Investor Self Employed Linkedin

Lending Assets Whyjoinlending Mortgage Broker

Maa Ex99 1s4 Jpg

Self Employed Mortgage Loan Requirements 2023

2023 Mortgage Guide For The Self Employed Moneygeek Com

6171 State Route 80 Tully Ny 13159 Mls S1370376 Howard Hanna